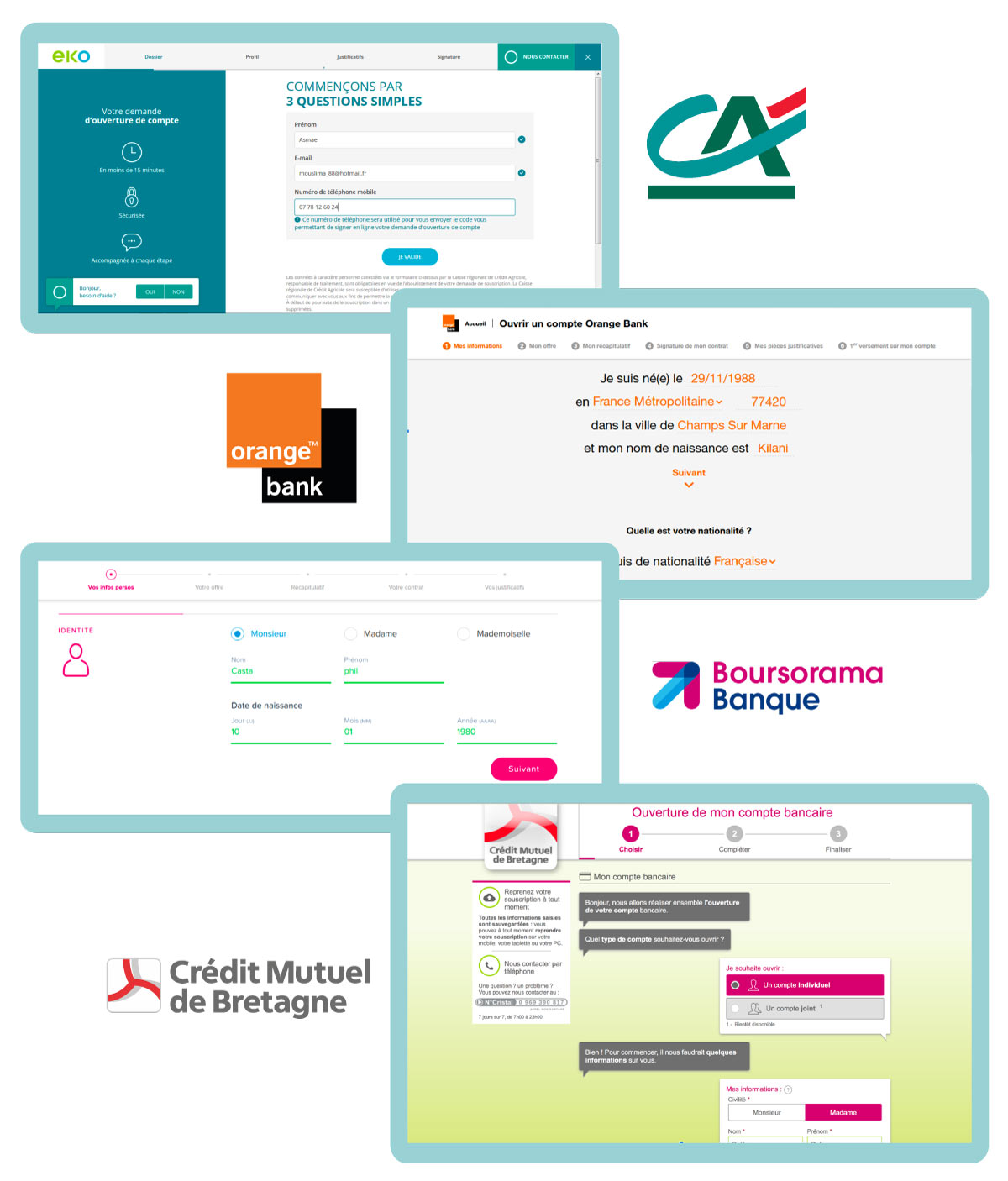

A comparative study to benchmark different subscription routes

Customer case: Crédit Agricole

The context: challenging the current chatbot trend

- The Crédit Agricole Technologies and Services team wishes to work on a new subscription journeys for professionals.

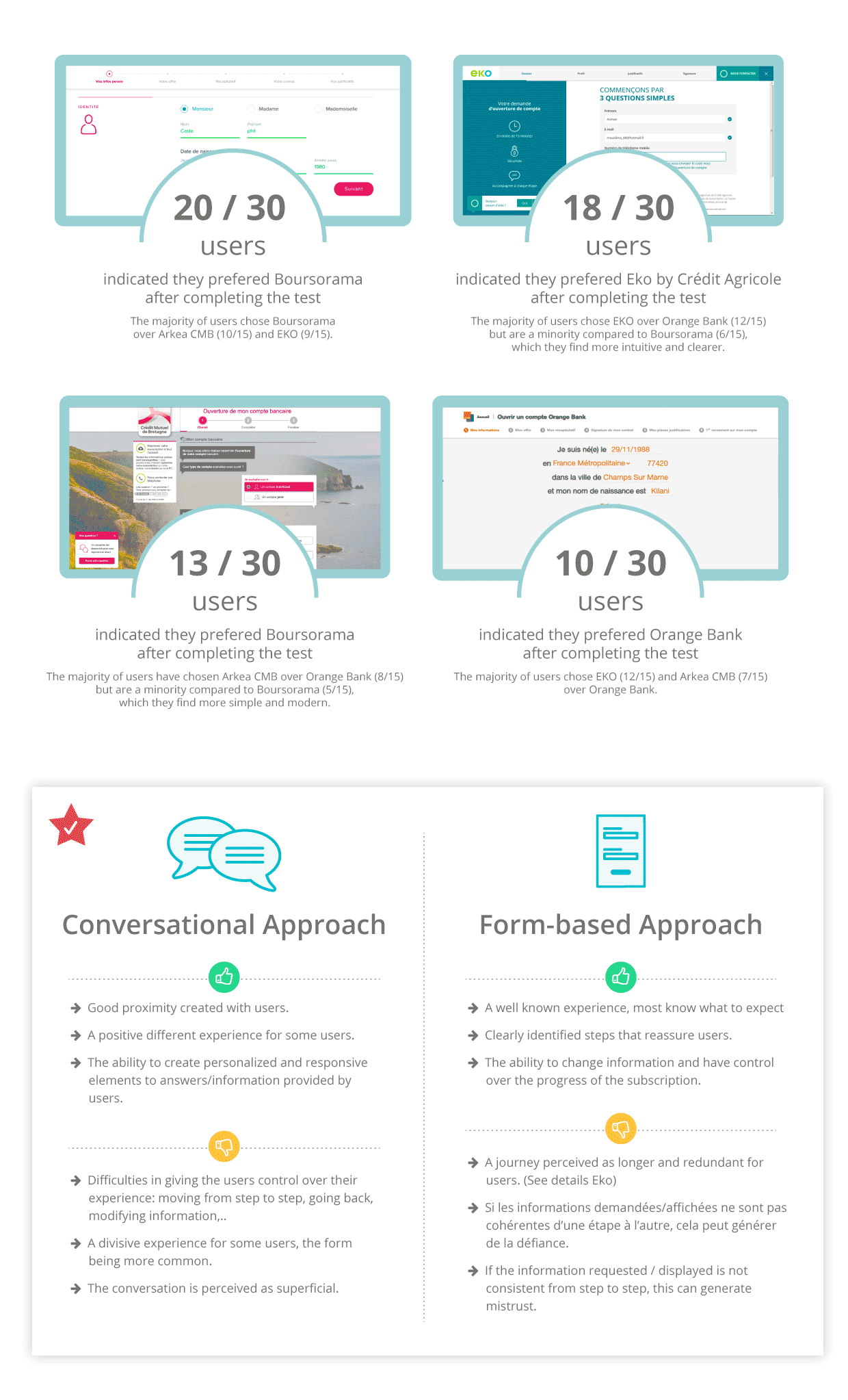

- Conversational interfaces, such as chatbots, are increasingly present in subscription journeys of the banking sector. "All agencies offer a conversational concept, all design sprints result in chatbot concepts, no matter what the business or user issue at stake is." (Marie Petit, User experience manager at Crédit Agricole Technologies and Services).

- The extent of conversational writing is a broad and complex, it includes the following:

- Human to human conversation with an adviser

- The chatbot by writing with no restriction in requests powered by artificial intelligence

- The chatbot with guided input and choices

- A conversation-looking style guide and tree view (“comics bubble” appearance on the Q&A form)

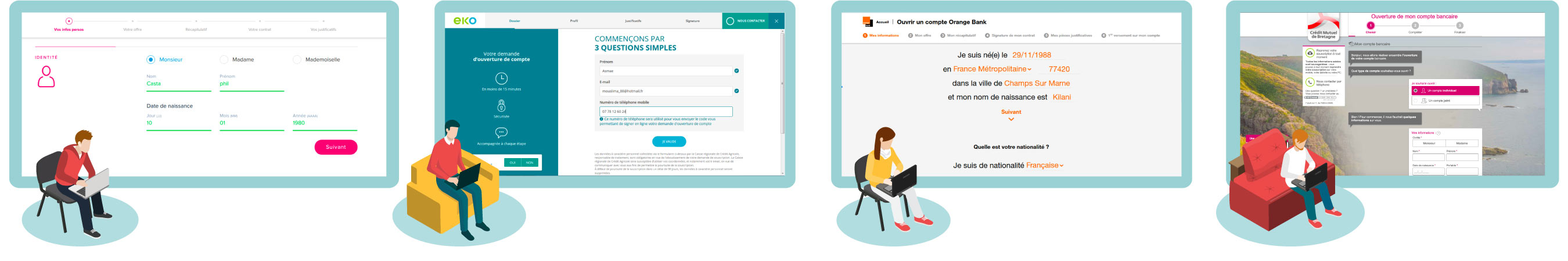

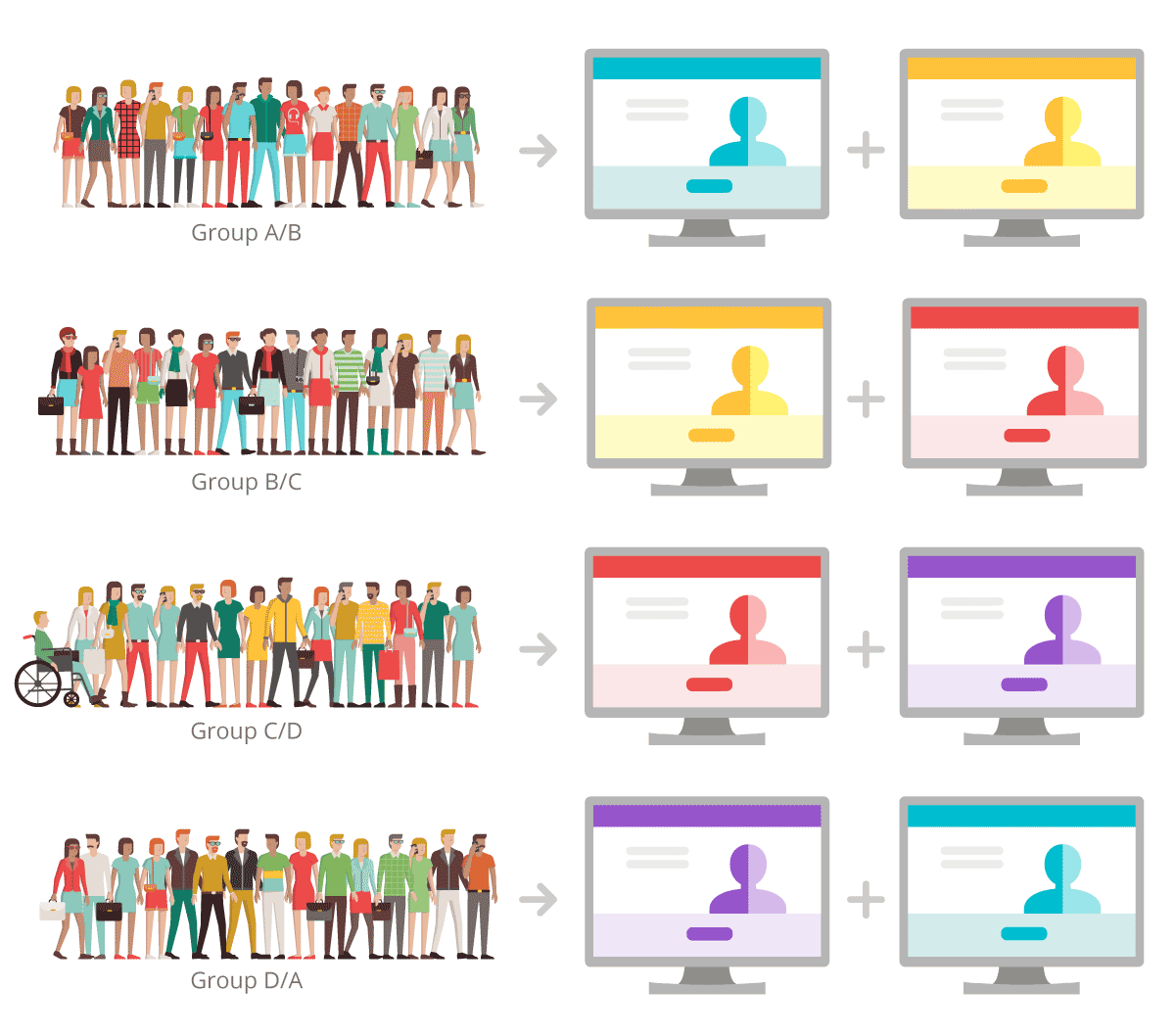

- The challenge was therefore to assess the relevance of a conversational approach to Q&A, in particular on an account subscription process. We chose to test and compare different options provided by competitors: a competitive benchmark was carried out by users.